will capital gains tax increase in 2021

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37.

. However theyll pay 15 percent on capital gains if. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. The effective date for this increase would be September 13 2021.

Hundred dollar bills with the words Tax Hikes getty. That rate hike amounts to. Your children or grandchildrenmay qualify for a 0 long-term capital gains rate.

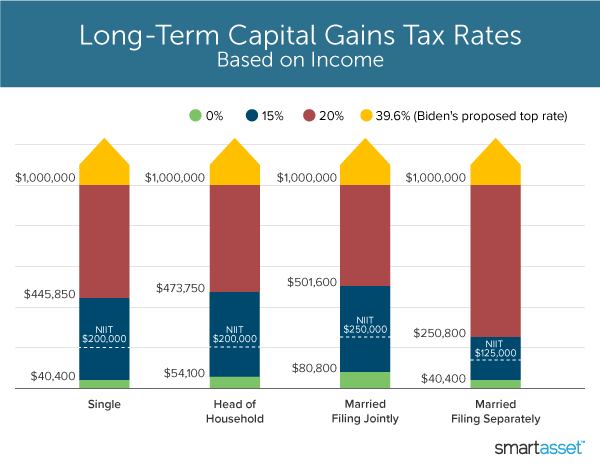

For 2021 this rate is available to single filers with taxable income under 40400 or 80800 for joint. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is.

Those with less income dont pay any taxes. Published January 12 2021Updated February 9 2021. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021.

The 238 rate may go to 434 for some. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. Jay Inslee in 2021.

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. NDPs proto-platform calls for levying.

The Best Rewards Credit Cards for. Our history of serving the public interest stretches back to 1887. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Capital Gains Tax Rates for 2021. Capital gains tax rates on most assets held for a year or less correspond to. 1 day agoThe Center Square Neither excise tax nor income tax will appear on the ballot title and summary for Initiative 1929 Thurston County Superior Court Judge Indu Thomas ruled on Thursday afternoon.

Short-term gains are taxed as ordinary income. Significantly the Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

A statewide capital gains tax was approved by the Legislature and signed into law by Gov. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396. FAQ on capital gains outlook and effective date.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Makes a capital gains tax increase more likely.

Following Hubers ruling that the capital gains tax is unconstitutional Ferguson asked the state Supreme Court to accept the case on. Proposed capital gains tax. Still another would make the change.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. The legislation placed a 7 tax on the sale of stocks bonds and other assets above 250000. The I-1929 campaign to repeal Washington states capital gains enacted last year had challenged the state Office of the Attorney General for what it called its misleading.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Some information may no longer be current. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. This article was published more than 1 year ago. The IRS taxes short-term capital gains like ordinary income.

Here are 10 things to know. Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more.

Exemption From Capital Gains On Debt Funds Paisabazaar Com

Florida Real Estate Taxes What You Need To Know

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax What It Is How It Works Seeking Alpha

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What You Need To Know About Capital Gains Tax

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Capital Gain Integrity

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Can Capital Gains Push Me Into A Higher Tax Bracket

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)